The extended-time Computer system gaming hardware soothsayers at Jon Peddie Exploration have a new notice out predicting rough moments for the marketplace in the shorter to medium phrase ahead of returning to growth in 2025.

But you will find a capture. JPR reckons mid-array gaming components is going to flatline when both the higher-end and low-conclusion segments experience a decent uptick in 2025.

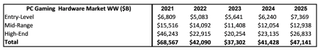

JPR’s figures (opens in new tab) also reveal just how enormous the hardware frenzy was in 2021. In accordance to their figures, the over-all Personal computer gaming components market place turned about a large $68.5 billion in 2021, dipping to $42 billion in 2022.

JPR forecasts $37 billion this yr, $41 billion in 2024, and then $47 billion in 2025. Drill down into individuals figures and it’s clear just how major an influence demand for large-conclude hardware had in 2021.

Of that $68.5 trillion determine for 2021, JPR claims absolutely $46 billion came from superior-conclude hardware. That plummeted to fewer than 50 {fa54600cdce496f94cc1399742656d2709d9747721dfc890536efdd06456dfb9} in 2022 at just below $23 billion for 2022.

In the meantime, entry-amount and mid-assortment components also dropped off, but only by relatively smaller amounts. JPR’s forecasts for 2023, 2024 and 2025 see comparatively small progress in the mid-array even though equally higher-close and entry-degree components appears more and more wholesome, albeit absolutely nothing on the scale of the bumper year of 2021.

As for why, at the low close JPR reckons Intel’s entry into the graphics sector with its Arc GPUs, which include the Intel Arc A770 (opens in new tab), is serving to to strengthen that segments, along with older AMD GPUs which the analysis outfit says are continue to becoming made.

In the meantime, at the substantial-finish of the Computer industry JPR states “a renaissance in Personal computer gaming screen development with avid gamers gravitating toward ultra-extensive screens with Significant-Conclusion aspirational items now accessible in 5K and 8K resolutions.”

Internet result? “This increase in display screen resolutions will power players to upgrade their devices so that they can attain smooth body rates.”

That’s quite a assert and not just one I entirely share. Will players genuinely be getting 5K and 8K displays in huge more than enough volumes to impression the marketplace on such a wide scale?

There are very couple these displays available currently and existing roadmaps for upcoming Lcd and OLED panels (opens in new tab) from the significant names in the sector, together with the likes of LG, Samsung and BOE, have incredibly handful of future panels that in shape into these classes.

That stated, just one matter we do agree with is JPR’s broader assessment of wherever the aim of Computer system gaming components is these days, with significant-conclusion expansion as a consequence of “a aim by suppliers in this class but at the expenditure of producing Mid-vary choices.”

Nvidia and particularly AMD have been rather slow to roll out more very affordable desktop variants of their most recent RTX 50-collection (opens in new tab) and RX 7000 GPUs (opens in new tab) and you can find no doubting that graphics playing cards in specific have shifted significantly upmarket in latest decades.

The slightly challenging bit is that it can be not thoroughly distinct how JPR defines the three segments. Is an RTX 4070 Ti (opens in new tab) significant-conclude? What about the RTX 4070 if it does in fact launch at the rumoured $599 (opens in new tab)?

Likewise, GPUs are now a bit of an outlier with pricing of most other major Computer system hardware factors returning to what you may simply call regular amounts (opens in new tab). SSDs are now tremendous low-priced, DDR5 memory way much more inexpensive than it was, you can get a good 34-inch ultrawide check for $250, and AMD AM5 motherboards can now be had for nicely less than $100.

So how much JPR’s conclusions apply throughout the board as opposed to just graphics cards is an open up concern. We’re not entirely persuaded. But then all over again, JPR’s forecast numbers really don’t essentially clearly show a big change to the large-conclude, far more a flatlining in the mid-assortment and a bit far more growth on both facet, which appears plausible more than enough.